Historically, Silicon Valley has been obscenely bad at capturing the value it creates. From Amazon to Salesforce, the true value add of Prime delivery and the organizational prowess of Slack is seldom reflected in the AMZN 0.00%↑ or CRM 0.00%↑ market cap. In the last year, we have seen the most acute example of such failure in the form of generative AI.

Such models and their derivatives, delivered by a menagerie of startups, offer the potential for immense productivity gains to individuals and enterprises globally. Not to restate what has been rehashed on X many times over, but $20/month for ChatGPT is beyond a bargain for the value it offers to its users. LLM startups have largely failed to capture more than an iota of this value that they create. The story of software has been getting more value for less, and LLMs are at the extreme end of this trend. “GPT wrappers“ as they’re often derisively called seem to lack the potential for “venture scale returns“, the home runs that investors wear as badges of pride on their chest, relegated instead to a cottage industry of small, profitable yet never ultra-successful enterprises.

Discourse around pricing has shifted to “selling work not software“ as Benchmark’s Sarah Tavel puts it. At first, this model may seem promising—rather than charging for seats, maybe charge for “help tickets dealt with“ or some related measure of work. But are customers really willing to pay close to human wages for automated work? Is it worth firing an employee and switching to a new system if the employee’s say $50,000 salary is replaced by a $45,000 AI bill? I think not. Software has consistently provided more for less, and I doubt this trend is bucked by expensive LLM-powered SaaS. At an exorbitant price tag, and with software easier to develop than ever before (see Devin), startups are at risk of their software being undercut by others or developed in-house by clients. Klarna, for example, offloaded two-thirds of their customer service chats to an AI assistant developed in-house using OpenAI. This assistant does the work of 700 full-time agents and is estimated to add a $40 million profit improvement this year.

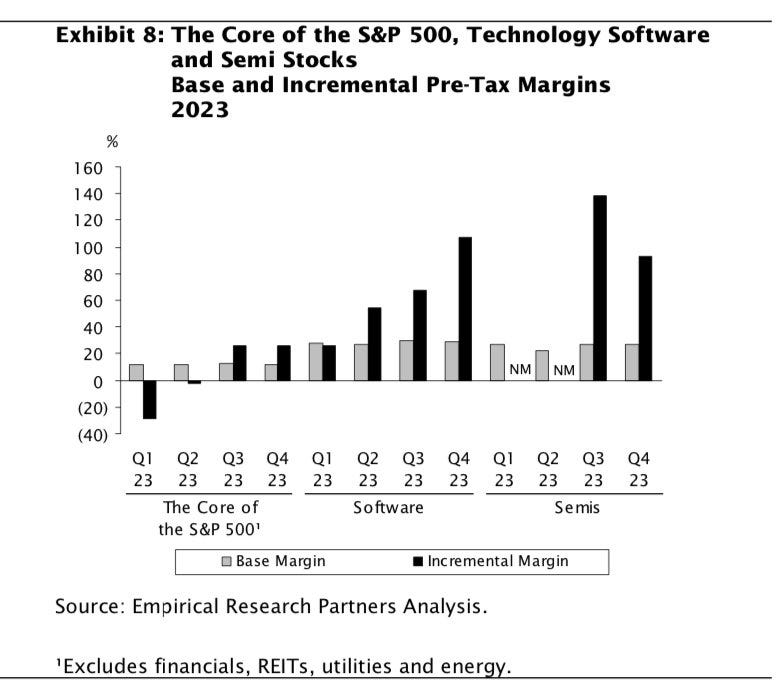

Unlike many previous platform shifts, generative AI seems to drive bottom-line growth, not top-line. The shift to the internet and then to mobile allowed businesses (like the humble bookstore) to reach more customers—ergo revenue growth. Generative AI doesn’t do this—it instead allows the same task to be done better and cheaper.

So then what’s the solution? How does value capture occur with generative AI? My guess is it happens by owning the underlying asset. Between data moats and the deflationary economics of generative AI it’s becoming increasingly clear that this technology is accretive in nature. Buy a business and use AI to automate away workflows and expand margins. For example, a multitude of white-collar services are still done manually in small to medium-sized businesses globally—if you can automate away a key workflow, rolling up businesses that depend on said workflow and using AI to drive bottom-line growth offers a promising playbook for aspiring entrepreneurs.

It’s certainly a less “sexy“, lower margin proposition when compared to a high-flying startup, but this is how software will finally eat the world. Last October, computer vision startup Metropolis bought out SP+, a parking lot operator, with the intention of implementing its technology to improve efficiency in the parking lot business by enabling a “drive in and drive out“ payment system for customers. I expect to see similar acquisitions becoming commonplace in the future. Most businesses globally are not tech startups funded with venture dollars—by adapting to this reality and implementing cutting-edge AI within them, a new model for value capture in Silicon Valley will be born.

This “private equity” approach to automation allows for the preservation of existing distribution, customer, relationships, and regulatory statuses that startups often have a tough time acquiring. As higher-quality foundation models lead to shrinking software margins, the true value of a business will be in those aforementioned areas. While Silicon Valley is a master of technological innovation, little innovation has occurred in its business model—perhaps the advent of generative AI will finally necessitate this change.